When Does a Business in Decline Need to Consider Turnaround?

These are the telltale indicators that a company should be considering turnaround.

Whether a company is in early stages of decline, well into weak market standing, or in full crisis, the turnaround procedure presents massive financial, operational and emotional challenges to everyone involved, and boards will inevitably be woven into this entire process. Identifying and setting operational issues back on track to return a company to sound profitability is a struggle, but it is never too early to start the turnaround process: it’s said that good managers practice turnaround skills every day. And, to a certain degree, knowing the stages of decline can help leadership discern the probable degree of success from turnaround.

But when it’s about survival or certain death, it’s almost inevitable that leadership teams will have to bring in outside professionals to address the systemic problems, so that a strong enough course can be set for a sustainable future.

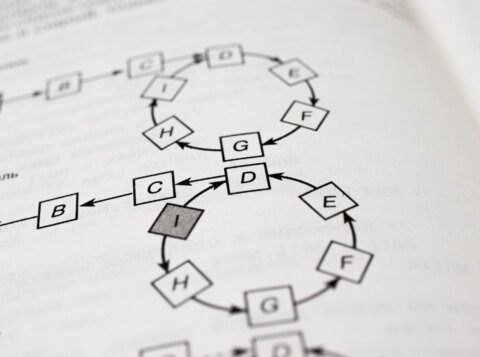

These are the three stages of decline that companies face, plus the defining conditions that lead them to make efforts toward remediation. Of course, it’s easier to be successful with restructuring initiatives for a company in early to mid-stage decline than a late-stage company—turnaround efforts are going to be far less valuable later on. Let’s look at each stage and the telltale indicators that a company should be considering turnaround.

Early Stage Decline: Missed Projections, But Continued Liquidity

Any company that’s starting to feel the market in getting away from them—that they can no longer keep up with the pace of change in marketplace today—should be taking a good hard look at their financials. Let’s say that your company is marginally profitable, but you have consistently underperforming results—that is, you’re not hitting the return on equity that your investors desire, or your other projections. If a manager says, “I’m missing my projections,” that should be a red flag that action needs to be taken.

The first question to ask is, what liquidity do you have available? Companies should continually test the cash out versus the cash in for a discrete period of time. While this may seem like an obvious and logical tactic, many companies miss it, as the information may come through inconsistently. The reason for understanding your company’s liquidity, especially if you are in early stage decline, is simple: though it’s ultimately worth it, a turnaround takes time and money to enact. By understanding your access to liquid funds, you can begin to build a plan toward renewing and revitalizing your company.

Many companies in early-stage decline will still have enough time and money to fund a turnaround. Explore the steps you can take to make it happen. What levers can you pull? We’ve seen many successful strategies hinge around cleaning up a company’s approach to sourcing or procurement, for example. A turnaround effort can be tremendously successful in an early-stage company, whether you’re in decline or missing your targets.

Middle Stage Decline: Default on Covenants

Decline can come from a variety of sources—disintermediation, the channels of retail and how things are being sold today, and changes in healthcare delivery are just a few examples. But any way it comes, a company that’s in mid-stage decline has lenders, customers and employees who know it’s in distress.

We discussed how, in the early stages, a company might miss a projection on their business plan. If you’re in the early stage of decline and you realize that you’re missing a projection, if you do something about it, it’s not going to be visible to the outside world. However, if you don’t do anything about it—if you’re not a really good manager—you’re not going to be able to keep up with the marketplace. Here, we might hear a manager saying, “The industry is turning away from me.” In reality, that manager is not reconfiguring the company to where the industry is heading.

As problems advance, the next defining moment is when a company begins to default on covenants. Failing to meet debt covenants, or approaching refinancing obligations, are solid indicators that a company is in middle-stage decline. Management has failed to meet its plan, with seemingly no credible plan to fix things. It’s time to take action before the financial workout teams arrive.

At this stage, a company should be well aware of its Frisk and Z scores—indicators of a company’s creditworthiness, and predictors of bankruptcy. Their creditors and competitors will have already made themselves aware of these. All the more reason to become aware of what others already know. But while companies need to regularly monitor these scores, they shouldn’t be overwhelmed by them: they are indicators that can help determine a platform for action.

We’ve discussed how the stages evolve, from missing a business plan, when the manager knows he’s got a problem, to a small ‘d’ default, where you’ve fallen short of the business plan. Once you default on your covenants, whether they are your own internal projections with your shareholders or external contracts with vendors and others, it will become more challenging to gain access to capital. However, in this second, mid-stage of decline, it’s still possible to have enough access to capital that you can use your services to maximize the return with your potential clients. You may just need more help get there—for example, by bringing in experts who can help you get better leverage with creditors. A positive and successful outcome from turnaround efforts is less assured, but still achievable.

Late-Stage Decline: Major Default, No Liquidity, Customer Issues, Viability in Doubt

We’ve touched on the importance of having good management in place, and a key attribute of good management is acknowledging and facing the fact that there is a problem. At the late stages of decline, we often see management that’s in denial—where the company has no liquidity in place, and they really don’t have a plan to fix their operations. They’ve stretched their balance sheet, and they’re simply too paralyzed to act. Sometimes, if there has been significant disruption in the industry—a fact of life in practically every industry today—leadership will huddle and conclude that while it may affect some of our industry, it won’t affect us to a large degree. They put their head in the sand—call it the “Ostrich Syndrome”—and just let things decline around them.

Managers of companies at this stage are in a double bind. They don’t know what to do, so they freeze or become ostriches. On the other hand, if they don’t stick their head in the sand, they often make bad decisions under stress. Good managers probably make 90 percent of decisions right, but if the business is under stress, that number becomes inverted—those same managers might make only 10 percent good decisions. It’s been proven that even good managers don’t always manage their way out of trouble very well.

What gets a company into this state? There can be a number of factors, from a gradual decline into irrelevance in the market—through not staying competitive with pricing, failing to supply a product that people want and need, or turning a blind eye to the constantly changing demands of technology—to major, negative business events that seem to spell ‘the end’ for a company. These can include the destruction or unplanned closure of a main facility, the loss of several crucial employees, the loss of a key client or customer. While events like these happen regularly, and should come as no surprise to business leaders, an unprepared organization can become paralyzed, and/or have muted, short-term reactions to them.

If this is the case, seeing above the roiling waters of trouble becomes impossible for these companies to achieve on their own. Liquidity is gone. Customers know there are deep problems and take their business elsewhere. Seeing their main customers are no longer purchasing their product, a company may have just enough vision to realize they need to set a course, often developed by restructure specialists who can maintain objectivity, to design and effect a turnaround—at minimum, to help with sourcing and gaining incremental liquidity to help fix their business. At this stage, the odds of successfully transforming the company and getting it back on its feet are slimmer but not impossible.

The Early Bird Gets the Successful Turnaround

Some organizations will perform well after a turnaround, while others will suffer ongoing problems and may ultimately fail in their turnaround efforts. It’s impossible to overemphasize the importance of getting as early a start as possible on these efforts. Paying attention to the financial details of the company so that you can recognize the beginnings of trouble will allow the emergence of a believable and timely plan. Understanding the company’s liquidity and having—or gaining—access to the capital necessary to fund the turnaround is key to success. And, as we’ve seen how many organizations experience the grind of turnaround efforts that can go on for many years or even decades, another critical ingredient when embarking on a turnaround is setting a realistic timetable in which to get it done. Without a paradigm shift in the company—which includes a real-time perspective on technology, and the customer—these structural matters can predicate whether a turnaround will be successful, or if the situation is too deeply entrenched.

This article was originally published in Financial Executive.