Key Considerations in Moving Toward a Value-Based Care Health System

Over the past decade, the US healthcare industry has seen a gradual shift away from the traditional fee-for-service (FFS) payment system to one that is based on the delivery of value-based care (VBC), which rewards healthcare providers for providing high quality care at a lower total cost of care. While the pace of this shift has been somewhat slow, there is consensus that it has been accelerated by the pandemic due to factors like COVID-19, leaving health care providers that relied on FFS payments with reduced revenue as volumes are declining as the Federal government is continually promoting value-based payment models as a way to better control Medicare spending. We expect this shift to continue, and each provider will have to determine how to best advance their VBC capabilities.

VBC Differentiators

Health systems require a range of capabilities to succeed in a value-based care environment. They need to develop a network of physicians and optimize their referral relationships and care coordination processes. Several clinical capabilities are important to supporting VBC, including a redesigned care model, clinical variation reduction, and enhanced, real-time quality management for primary/preventive care as well as specialty care to support disease management. New consumer engagement capabilities, including the adoption of digital health technologies that directly link consumers to providers in the health care ecosystem, are required. Risk-based financial planning and contracting expertise are among the needed financial capabilities. Underpinning the move toward VBC are enabling capabilities like embedded, real-time population health and care management competencies integrated with deep analytic capabilities around behavioral and other social determinants of health, which are enabled by access to robust clinical, claims, and cost data.

Despite the widespread understanding of the need to develop these enabling capabilities, most health systems lack an overarching value-based care strategy, governance process, and tactical road map to accomplish the transformation from FFS to a VBC payment system. Few health systems have developed a comprehensive board-approved strategy or “blueprint” to transform to a VBC enterprise which would also include a well-thought out and planned approach to sustaining operating margin during the shift from FFS to VBC. Nor have many taken the step of selecting a single VBC leader to lead the transformation under the oversight of a well-defined, multi-stakeholder, governance.

Build or Buy?

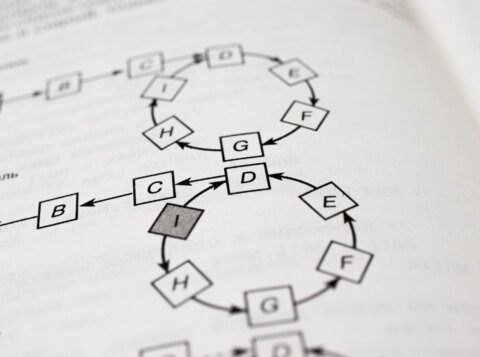

A health system seeking to transform into an organization that can succeed in a value-based care environment must decide whether to “build” or “buy” needed VBC competencies. Alternately, they may opt a “partnership model” approach that involves teaming with an organization that has the broad array of necessary VBC capabilities or even merge with an organization that possesses more mature VBC capabilities. Figure 1 provides an overview of the key differentiators between the buy/build and partnership models.

Buy/Build Model

- • Health system-driven design supported by a skilled advisor with knowledge and experience in transforming health systems to VBC

- • Uses a blend of an advisor’s/vendor’s proprietary tools and capabilities other “best of breed” tools and capabilities, and the health system’s current capabilities

- • Governance and operational control remains with the health system

- • Term-certain engagements with advisor and/or vendors with short-term risk sharing

- • Health system gains the knowledge as core to process

Partnership Model

- • Economically aligned relationship with a third party

- • Externally-driven design but may have health system input to customize/co-create

- • Use proprietary tools and solutions already developed by the external organization vs. internally-developed or other vendor tools and/or solutions

- • Managed services/outsourcing approach and co-governance with external entity having some or all operational control coupled with investment in certain capabilities

- • Long-term arrangement

- • Knowledge transfer to health system is limited due to external organization providing the solution

In trying to determine which path toward VBC to pursue, a number of considerations need to be thought through. To what extent does the health system already possess the necessary VBC capabilities at scale? Is there time to build the needed capabilities, or is the market moving too quickly? Are there senior leaders in the health system who have relevant VBC experience? Does the health system have sufficient experience with the level of major transformational change that will be required? Does the health system have available human and financial resources to focus on an internally-driven VBC transformation? Would it be advantageous to consider merging/affiliating with another health system that has the requisite capabilities?

If a health system decides to undertake an internal “build/buy” transformation, a similar build-or-buy decision-making process should be undertaken for each of the VBC capabilities that the health system needs to develop. For each capability, the health system needs to address a range of questions. Is there a total, turn-key solution available in the market that provides the capability, or does the capability require customization to be effective? Can the capability be outsourced? Does the health system have some or all the competencies already in place to achieve that capability? Is the capability urgently needed or is there time to develop it? Is the capability a commodity or a genuine differentiator that can provide the health system with a strategic advantage? What is the relative cost of buying the capability as opposed to building it? Does the health system have the human and financial resources to build the capability? If purchased, what is the likelihood that a capability would become outdated? The answers to these questions should inform the organization about how to develop the VBC “blueprint” under the “build/buy” approach. If a health system decides to undertake a “partnership model” transformation approach an alternative array of questions should be used to guide the selection of the transformation partner. Can the partner’s VBC model be appropriately tailored to the health system’s requirements? What is the partner’s level of financial risk, and is the risk sharing fair between the parties? What commitments is the partner willing to make around future investments in innovation and new VBC tools/capabilities? What is the health system’s decision rights relative to the operating areas involved in the partnership? Is there a strong cultural fit with the partner? What are the termination provisions and unwind arrangements? Is there a loss of flexibility, control or undue regulatory risk associated with the managed operations? Will the partner agree to exclusivity? The answers to these questions should similarly inform the organization about how to select the best suited partner for the “transformation approach.”

Critical Success Factors

Health systems making the shift to value-based care face a somewhat daunting journey. In our experience, there are a number of critical success factors that can help to guide the way.

- An aligned governance, CEO and management team that are committed to make the VBC transformation is an essential first step. All key stakeholders must believe in the strategic advantage of moving toward VBC as the health system’s business model.

- Second, an in-depth understanding of the population served by the health system, including its demographics, variation and disparities, is needed to help guide the VBC operating model design and resulting “blueprint”.

- Third, a board-approved “blueprint” should be developed to map the transformation to VBC. Among other considerations, this blueprint should outline the overarching governance process. It should also set forth the necessary capability development, including whether the “build/buy” or “partnership model” strategy will be used. Additionally, it should set targets, including any needed financial improvements to core operations to sustain margin and fund transformation, to make the transformation to VBC over a three- to five-year time frame in a way that preserves or even enhances financial performance.

Additionally, an effective change management strategy will need to be developed. The strategy should consider all stakeholders – patients, physicians, employees, payers, and the community to name a few. Strong relationships will need to be forged with all these constituents, with mechanisms developed to provide health system leadership with feedback throughout the VBC transformation.

Finally, in either model there is a distinct need to ingest data and develop insights that drive decision-making. Managing a VBC arrangement and its clinical and financial outcomes requires near real-time analysis of what is working. Measuring and managing contract performance is a critical success factor, and demands insights from available data. Multiple data sources will feed this insight engine, including EMR, claims, ERP and CRM systems, and others that may include demographic and patient-derived data. Most health systems struggle to find the capacity and capability to fully realize this key component, and often require a 3rd party to assist.

Driving the Market to VBC

With VBC, we firmly believe that it is a question of when, not if, it will become the dominant healthcare business model. Leadership at each health system will need to determine if it will serve as a market disruptor to move the market to value-based care or if it will be a market follower. Disruptors will have an advantage, as they will be able to take a more measured and incremental path toward VBC rather than being forced by payers or other market forces to make the transition. The risk, mild as it is, of being a market disruptor is that the market may not move as planned, potentially leading to loss of financial margin.

Those health systems seeking to be a market disruptor should begin to act now. Start by building the case on how the transition will lead to sustainable success for each stakeholder. Create financial incentives for all stakeholders to make the shift to VBC; for example, change physician compensation or create other financial incentives for physicians to move to VBC. Those health systems that are already dominant should leverage their position to establish payer/provider partnerships or other structures to move to VBC. Finally, we recommend that they accelerate care redesign and effective clinical management by providing physicians with the tools needed to provide real-time care management.

A Cooperative Authorship with Robert Clarke

Robert Clarke, Principal at The Avec Group, a consortium of seasoned healthcare professionals who help our clients understand key market forces and trends and develop responsive strategies supported by insightful analysis. Avec provides Strategic Advisory, Financial Advisory and Performance Management & Analysis services.