Improving Operational Efficiency With Automation

A pair of cost-effective, easy-to-implement technologies can make tremendous improvements in claims processing accuracy and other data management tasks.

While many companies have responded well to the COVID-19 pandemic, the crisis has revealed or amplified weaknesses across the business world. Supply chain and manufacturing issues have affected a range of industries. IT departments across industries have been badly strained by the sudden surge in new remote workers needing virtual private network (VPN) access, video chat and other new capabilities. As the pandemic plays out, these technologies and others will have increasing value in the finance function across industries—including healthcare, insurance and financial services, and manufacturing. Here, while we’re taking a closer look at changes in these technologies as they relate to the healthcare ecosystem, we believe this discussion has broader relevance to many other businesses.

Now, at a time in healthcare when claims management teams struggle with productivity issues exacerbated by the remote environment, health insurers not only face the ongoing issues that cause inefficient and inaccurate claims payments, such as illegible forms and out-of-date physician rosters, but they also have to deal with the plethora of new irregularities and billing errors that result in an environment of new and frequently changing rules.

For health insurers—and, we would argue, for many other businesses that suddenly find themselves with a remote workforce that still has to deal with a centralized administrative system—it does not have to be this way. A pair of cost-effective, easy-to-implement technologies, optical character recognition (OCR) and robotic process automation (RPA), can make tremendous improvements in claims processing accuracy and other data management tasks. On their own or together, OCR and RPA help to save costs, reduce errors, increase productivity, and free up people to do more high-value work.

While it is a relatively old and seemingly humdrum technology, OCR tends to be underutilized in the payer claims environment, where providers continue to use their own home-grown, non-searchable means to communicate with payers, and payers continue to maintain information in inconsistent, non-searchable formats. OCR is about more than simply scanning documents. Used to its full potential, OCR makes text searchable so pertinent information can be extracted from handwritten and word-processed faxes, forms, notes, images, and photocopies, including those files in portable document format (PDF). Just think of how, in order to process mobile deposits, banks are able to “read” checks from a photo taken by your phone. The text is translated to a consistent, searchable format that can be placed into workflows.

OCR is useful in claims processing, as certain providers continue to use faxes and the U.S. postal service to submit a significant percentage of claims, especially when electronic data interchange (EDI) is not a regulatory or contractual requirement. The resulting manual entry of claim information tends to be time-consuming and prone to mistakes; OCR systems reduce both turnaround times and error rates.

In addition to adjudication, there are a variety of use cases impacting the claims process. OCR systems can be trained to identify and pull out specific portions of provider contracts, such as contracted rates and carved-out payment terms, necessary to configure a payer’s adjudication system. Similarly, OCR can be used to improve the turnaround times for prior authorization requests as well as appeals by categorizing them for routing to the correct workflow. In healthcare, physician rosters and associated add/change/terminate forms are another area prone to slow turn-around times and significant error rates (and resulting payment inaccuracies) for which OCR yields significant improvement. Additionally, OCR can be successfully applied in the areas of provider credentialing and invoicing.

Be it a result of illegible handwriting, darkened photocopies, or fax transmission deficiencies, some indecipherable text will still need to be examined by the claims team. However, OCR enables parsing out documents into those that have been successfully translated and those at greatest risk of translation error, thus requiring manual review. This brings significant improvement to the efficiency and accuracy of many payer processes. We estimate on average a task replaced with OCR reduces the need for over 90 percent of current manual review processes.

RPA, which is also known as intelligent automation, digital automation, or even simply by the colloquial term “bots,” centers on the use of software to do repetitive tasks of the sort that few workers truly enjoy performing. Any corporate employee at the level of middle management or below will be able to relate to the need for relief from an overabundance of busy work, especially now. For health insurers, this work tends to revolve around areas like provider data management, physician roster validation and standardization, and fee schedule management, all of which are susceptible to develop sizable backlogs. A properly programmed bot can quickly work through backlogs while avoiding the types of errors people are prone to make when doing relatively monotonous work, especially as the hours stack up.

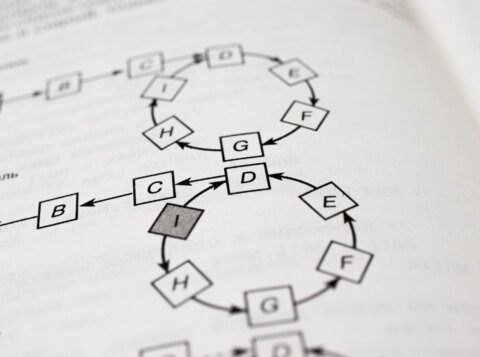

RPA systems are much more sophisticated than commonplace tools like desktop scripts and macros. They essentially mirror human activity, driving applications through user interfaces to operate applications while following business rules and validating provider data at near 100 percent accuracy and at speeds up to five times faster than employees. As much as people are trained through decision trees, RPAs are programmed to follow predetermined pathways between their assigned tasks and data repositories, move or populate data, make calculations, perform actions, and even trigger downstream activities. They can also run around the clock, and never need a coffee break.

So, how can you decide whether RPA can help your organization? In our experience, the best-fit criteria for this type of solution are processes that:

- Are rules-based and repetitive

- Employ standardized, structured, or digitized data

- Have fluctuating demand or backlogs

- Require extensive people time

- Have high cycle times

- Require low error rates

Any of this sound like you? Using bots to automate processes brings many benefits. They improve the quality of provider data, lower administrative costs and help to gain operational efficiencies around the processes they are programmed to perform. They are scalable and flexible and improve data security because fewer people “touch” the data. Perhaps the biggest benefit is the time that RPA frees employees to work on higher value tasks and projects to drive improved business results by ensuring claims are paid accurately and on-time.

In many industries, technology has been advancing more slowly than the COVID-19 pandemic is demanding. For example, while the delivery of healthcare itself continually advances, both providers’ and payers’ back offices tend to be rather low tech. Their systems are antiquated, and their processes tend to be cumbersome. The pandemic has amplified this reality, as newly remote workers in the health insurance industry have struggled to keep up for want of ready access to the fax machines, multiple-display setups and other outdated tools they typically use in the traditional office setting. Better usage of OCR and deeper, more widespread adoption of RPA will help insurers and a broad swath of other industries enjoy the many benefits of present-day technology and prepare them for the new normal post-COVID-19, which will include much more remote work than required in pre-pandemic times.

This article was originally published in Mass Market Retailers.