GLP-1 Game-Changer: How Oral GLP-1s Will Shape Health Plan Strategy

This is an AArete Healthcare Payer insight

Injectable GLP-1s for diabetes and obesity are the fastest-growing drug spend category for payers. Now, a new market entry from Novo Nordisk has changed the game.

The Wegovy (semaglutide) pill is the first FDA-approved oral GLP-1 medication for weight loss and cardiovascular risk reduction. The monthly cost could be less than $150 (at the lowest dose) for cash-paying customers, significantly lower than the $1,500 cost of a weekly injection. For people with insurance, the cost may be as low as $25 per month when using manufacturer coupons.

The convenience of oral GLP-1s, coupled with direct-to-consumer (DTC) sales, will likely drive demand for specialty weight-loss drugs even higher in 2026. Health plans, already experiencing increased utilization and rising medical costs, must adapt their coverage and utilization management strategies without eroding member satisfaction.

The DTC–Payer Disconnect

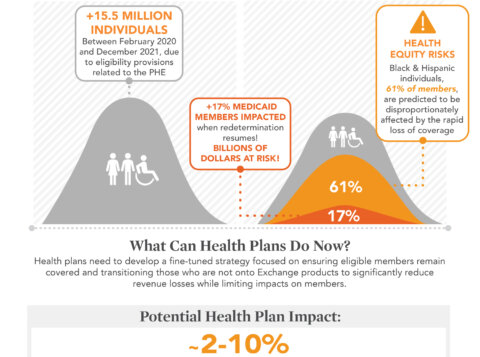

Manufacturer coupons and direct purchasing programs are growing popular consumer options — the Lilly Direct channel accounted for 45% of new prescription volume for obesity drugs in Q3 2025 for the injectable GLP-1 tirzepatide (Zepbound). While DTC purchasing has lower initial out-of-pocket costs, it can create downstream problems for both members and payers.

First comes member satisfaction and affordability. Manufacturer assistance programs, such as coupons, and DTC purchasing do not count toward insurance deductibles or maximum out-of-pocket (MOOP) caps.

Bypassing insurance benefits reduces member out-of-pocket costs but also causes member confusion and complicates benefits coordination for health plans and PBMs.

Next comes the optics. When the introductory DTC price ends, members return to their insurance plan. At that point, traditional utilization management strategies such as prior authorization or step therapy become hard to apply without appearing to interrupt an established course of treatment. That means prior authorization programs may not deliver the expected savings.

And while Wegovy is the first daily oral GLP-1 medication approved for weight loss, it won’t be the last. Lilly’s orforglipron is under FDA review for obesity, with approval expected this year. Novo Nordisk’s Rybelsus, already approved in oral form for diabetes, is expected to be submitted for weight-loss approval at higher doses in 2026. Other similar products are in early-stage development and could hit the market in 2027 and beyond.

What Payers Can Do Now

As drug manufacturers ramp up their production of oral GLP-1s, payers must stay ahead of the shift or risk greater utilization and cost pressures. A few proactive approaches:

Update coverage and utilization management policies

Develop rules for weight-loss and non-weight-loss coverage and limits such as quantity limits for new therapy starts to avoid the waste that comes from members discontinuing due to side effects. Consider modifying review and approval committee structures so decisions on new drugs can be made in weeks, not months. Other steps could include requesting real-time data from pharmacy benefit manager (PBM) partners and early review of high-cost drugs in the pipeline so that coverage and UM decisions can be made quickly upon FDA approval and market release.

Monitor PBM pricing strategies closely

Ask PBM partners how oral GLP-1s will change rebate structures and adjust utilization management strategies accordingly.

Communicate clearly with members

Address member concerns up front with educational messaging explaining how DTC purchasing programs and manufacturer coupon cards impact their copay accumulation toward their deductibles.

Support members in a shift to DTC purchasing

Because prior authorization programs aren’t always effective at managing GLP-1 spend, commercial plans may choose to exclude GLP-1 for obesity and encourage members to use manufacturer purchasing programs instead.

Offer GLP-1 alternatives for weight-loss coverage

Guide members to lower-cost first-line drug therapy options already available through their benefits rather than defaulting to high-cost GLP-1 drugs. Supplement GLP-1 coverage with nutrition programs and lifestyle coaching.

Develop a deprescribing initiative to reduce overtreatment and risk of harm

Leverage medication therapy management tools for a comprehensive medication review for members with diabetes using a GLP-1 drug. Work with prescribers to consider discontinuation of overlapping medications, such as Sulfonylureas, Meglitinides, SGLT2 inhibitors, basal or prandial insulin and DPP-4 inhibitors.

Measure, measure, measure

Track member outcome KPIs to measure the clinical effectiveness of GLP-1s in driving down the total cost of care. Dashboard metrics can include fewer ER visits and decreased use of other medications as members lose weight.

Build a Proactive Strategy

Managing GLP1 therapies for obesity is a marathon, not a sprint. Because members typically need to stay on these medications long term to manage diabetes, sustain weight loss, and maintain broader cardiovascular, renal, and metabolic benefits, health plans face ongoing and escalating cost exposure. Instead of waiting for future oral GLP-1 entrants or potential price reductions, plans need to rethink and restructure their approach now. A proactive strategy is the only way to balance improved member outcomes with the rapidly rising pharmacy spend associated with these therapies.

Payers are redefining their PBM approach for 2025. Download this guide for practical strategies to address drug spend and enhance your PBM relationships.