Reading the Signals: Planning for CMS’ Proposed CY27 Direction

This is an AArete Healthcare Payer insight

With Medical Loss Ratio (MLR) pressure increasing and medical costs rising, most health plans already expected 2026 to be a reset year. Now, a sweeping set of proposed CMS rules for Contract Year (CY) 2027 raises the stakes even further, making it critical for payer organizations to get their houses in order over the next 12 months.

The new rules, released just before Thanksgiving, outline multiple changes that will impact Medicare Advantage (MA) plans if finalized. The two most significant: A reduction in the number of Star Rating measures and modifications to Special Enrollment Period (SEP) requirements. Although these rules will not be effective until January 2027, if at all, payers should start planning for them immediately.

Star Ratings: Fewer Measures but Continued Oversight

The proposed removal of 12 Star Rating measures related to administrative processes, such as call center activity and appeals and grievances, appears to be a win for plans. But a closer look reveals that CMS will continue tracking these items as display measures. That means it can still impose financial penalties or enrollment restrictions if plans do not meet certain thresholds. CMS will also monitor some of the removed measures through CAHPS surveys, asking members about items such as call hold times, appointment wait times, and the availability of translation services.

While many Star Rating measures may go away, one new one is important. The proposed Part C Depression Screening and Follow-Up measure could markedly improve access to appropriate treatment for the rising number of older adults struggling with mental health conditions, thereby improving outcomes. This measure is proposed to begin in CY27 and will impact the 2029 ratings.

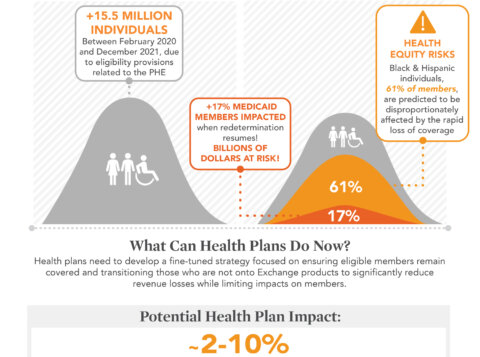

Concerning, however, is CMS’ decision not to implement the planned Excellent Health Outcomes for All reward (previously called the Health Equity Index reward) for 2027. CMS will instead revert to the historical formulary that rewards plans for performance across all star measures. The Health Equity Index was designed to track performance for the most vulnerable populations, who tend to have less access to healthcare, resulting in worse health outcomes. This decision will likely prolong those disparities.

SEP Revisions: Increasing the Risk for Member Churn

The proposed CY27 rules would also allow enrollees to change plans if one of their providers leaves the network, removing the former requirement that the MA plan and CMS had to deem the change “significant.” This proposed change comes on the heels of final amendments to disclosure requirement 42 CFR 322.111 that call on MA plans to submit provider directory data for publication in the Medicare Plan Finder (MPF), update it within 30 days of any changes, and attest to its accuracy annually.

For MA plans with inaccurate provider directories, these changes will cost both members and money. Per the new disclosure requirements, if a member joins a plan because their provider is listed in-network, then discovers that provider is out-of-network, the member is eligible to switch plans. Additionally, under the proposed rule, if a member’s doctor leaves the plan at any time, the member would be eligible to switch, even if it’s in the middle of a plan year.

Act Now to Prepare for CY27 Changes

With MA enrollment expected to decline by nearly 1 million members in 2026, plans cannot wait until CY2027 to see if the proposed rules become final. Organizations should instead focus on shoring up their internal processes so they are ready to stay compliant. Three places to begin:

1. Streamline and Automate

Thoroughly examine your operations and look for any opportunities to improve workflows or automate processes. Doing so will free up limited resources, allowing you to redirect them to the new CMS areas of emphasis. A third party can give you an objective view of where your biggest opportunities lie and how to act on them.

2. Keep Provider Directories Accurate and Current

The SEP period changes make this step essential. Start by reviewing whether your data management system can capture provider changes quickly. Enhance verification to ensure information is correct before each quarterly attestation to CMS. And if your plan is not yet technically integrated with the MPF, you may need new IT processes, data quality checks, and automated submission workflows.

3. Evaluate and Strengthen Vendor Performance

Assess whether vendors supporting appeals and grievances, prior authorization, provider directories, and call centers can meet heightened CMS scrutiny.

4. Strengthen Customer Service

Remember that administrative Star Ratings may be going away, but CMS will continue to track them in other ways. Giving members easy and fast access to call centers reps will continue to be essential.

Most of all, MA plans should take all the proposed rules seriously. CMS has already imposed enrollment sanctions against plans that have failed to meet MLR requirements for three straight years, indicating a culture of increasing enforcement.

Turn Uncertainty into Opportunity

The next 12 months will give MA plans a rare opportunity to stabilize operations before CMS implements widespread change. Plans that use the time to enhance their provider directory capabilities, streamline workflows, improve data management, and focus on the member experience will weather a contracting MA market and position themselves for ongoing success.