Navigating IT Vendor Consolidation Post-Merger: Key Considerations for IT & Procurement Leaders

This is an AArete Profitability Improvement insight

Mergers and acquisitions promise efficiency gains and cost synergies, but those gains hinge on how effectively IT and procurement teams consolidate their vendors. Every merger inherits overlapping contracts, conflicting license models, and divergent pricing structures.

Handled poorly, costs rise and compliance risks multiply. Handled strategically, consolidation becomes a catalyst: an opportunity to modernize infrastructure, strengthen vendor leverage, and align IT capabilities with the new organization’s growth agenda.

Here are ways to best integrate IT vendors in a post-merger environment, not as an afterthought, but as a critical driver of long-term value.

Contract Structures: Decoding Complexity Early

The first challenge for post-merger teams is almost always contract complexity. One organization may operate under a flexible pool model that lets licenses scale up or down with demand. The other might be locked into a rigid SKU-based agreement that fixes spend regardless of usage.

That mismatch can drain millions. Consider the merger of a Fortune 100 financial services merger, unused license blocks sat idle in one company while the other faced shortages. By consolidating into a hybrid pool agreement, the merged entity reduced annual spend by 18% and gained the flexibility to grow.

Vendors often push for early renewals before the ink on the merger is dry. Resist the pressure. Map every agreement first, identify the most advantageous models, and phase out or renegotiate unfavorable ones. Doing so lays the groundwork for a unified, scalable vendor strategy instead of inheriting two incompatible legacies.

SKU and License Rationalization

Most mergers uncover a tangle of SKUs, entitlements, and license tiers for the same vendors. One company may hold premium licenses packed with advanced features; the other may be running lean on basic tiers. But the complexity doesn’t stop at licensing; mergers also reveal duplicate solutions serving the same function.

One entity may use JIRA for ticketing while the other relies on ServiceNow. The result:

- Overpayment for unused functionality

- Under-provisioned teams that can’t access the tools they need

- Audit risk if usage and entitlements don’t line up

- Operational inefficiency from maintaining multiple systems that do the same job

Rationalization solves all four. Start by aligning licenses to actual usage and business requirements, then evaluate which duplicate solutions to sunset. Eliminate redundant platforms, right-size entitlements, and plan orderly migrations from legacy systems to your target architecture. Develop ramp-down schedules for solutions you’re sunsetting to ensure smooth transitions that don’t disrupt operations. Redirect savings from these efforts into modernization initiatives. It’s one of the fastest, cleanest wins available during post-merger integration.

Hosting and Migration: On-Premise vs. Cloud

When two companies merge, their hosting strategies rarely match. One may still run mission-critical systems on-prem, while the other has already shifted most workloads to the cloud.

Rather than defaulting to one approach, evaluate each environment’s fitness for purpose. Which on-prem solutions can realistically migrate? What’s the right sequencing? Can those migrations be tied to new, more favorable vendor terms?

The merger provides an ideal opportunity to realign infrastructure decisions with the organization’s long-term architecture. Moving toward cloud-first strategies often improves scalability and resilience, but beware the trap of short-term extensions that keep legacy systems alive and drain future budgets.

Pricing Models: Per Developer vs. Per Application

Pricing structures can differ as dramatically as the technologies themselves. One company’s contract may charge per developer; the other, per application or per transaction. Without normalization, cost forecasting becomes guesswork and as usage expands, those differences can quickly erode expected synergies.

IT and procurement teams should:

- Compare pricing baselines side by side

- Model future demand scenarios under each structure

- Choose the framework that delivers predictable, scalable cost alignment

Standardizing pricing isn’t just a finance exercise. It’s how merged organizations preserve flexibility as they scale.

IT Asset Management and License Audits

Post-merger IT environments are a magnet for audits. Overlapping systems, inconsistent records, and unclear ownership create easy targets for vendors eager to enforce compliance and collect penalties.

A strong IT Asset Management (ITAM) discipline is the best defense:

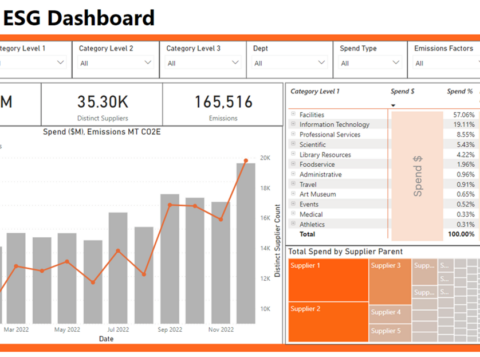

- Start with a baseline license audit across both organizations. Identify underutilized assets that can be reallocated.

- Reconcile entitlements vs. usage before vendors initiate their own reviews.

- Document ownership and build internal dashboards that demonstrate control.

Some true-ups are inevitable, but preparation transforms an audit from a crisis into a conversation. The added bonus: disciplined ITAM signals strength to vendors, often improving leverage in upcoming negotiations.

Building a Multi-Year IT Strategy

Consolidation is only the first step. The real goal is to position the merged company for sustainable modernization. That means aligning decisions today with a multi-year IT roadmap — one that reflects business priorities, not just cost pressures. For complex vendors like cybersecurity or enterprise infrastructure providers, the timelines are long: RFPs, migrations, and decommissioning can stretch well beyond a fiscal year.

Engage stakeholders early. Model best- and worst-case scenarios. Start replacement planning at least 12 months before key contracts expire. By engaging stakeholders early and conducting rigorous scenario planning, IT and procurement departments can ensure that consolidation efforts position the organization for sustainable success rather than short-term solutions.

Change Management and Stakeholder Alignment

But technology is only part of the story. Mergers often disrupt how people work: new tools, new access levels, new processes. Without careful change management, adoption slows and shadow IT creeps in.

To keep transitions smooth:

- Involve representatives from both legacy organizations in vendor selection and rollout planning.

- Communicate why changes are happening, not just what is changing.

- Equip managers to champion new tools and discourage workarounds.

Procurement’s role here is pivotal. It bridges commercial strategy and operational execution, ensuring end users experience continuity, not chaos. Vendor consolidation is one of the toughest aspects of any merger, but it’s also one of the best opportunities to capture merger value. Handled proactively and deliberately, it becomes a structural advantage: lower costs, cleaner governance, and a future-ready IT foundation.

Meet The Authors

Matt Burelbach

Manager