More Than Just Labor: Cost Reduction Strategies in the Banking Sector

This is an AArete Financial Services & Profitability Improvement insight

While the post-Silicon Valley Bank collapse seemed to suggest that banking industry turmoil is over at least for now, larger structural challenges remain. Investment bank revenues are plummeting, commercial bank earnings have experienced mixed results, the recession continues to loom, and market volatility continues to be turbulent. The result for financial services has been an increase in layoffs and bonus cuts, but these responses only scratch the surface of what’s possible. The industry must now look toward long-term cost-containment strategies that go beyond the workforce.

This initial response has been focused on quickly rightsizing the labor force, but more broadly for banks who continue to face a tight labor market with an ongoing “war for talent,” there are plenty of cost reduction strategies from other areas. This is where non-labor cost reduction strategies in banking become critical. As banks have seen headwinds impact their expense lines, the time is now to drive cost-cutting through nimble and innovative strategies across non-labor spending. The current mindset needs to change and the banks that respond will turn the volatility into a competitive advantage by both retaining critical talent and improving profitability.

How Did We Get Here?

Due to the pandemic, the roller coaster atmosphere from 2020 through 2022 impacted all industries, and cost management in banking became increasingly difficult as volatility persisted. Just as other sectors focused on growth amidst a tight and competitive labor market, financial institutions had to spend and hire aggressively across their workforce. 2021 resulted in a thriving banking sector supported by an economy that set the stage for growth. Consumers were flush with capital. Overall funding was cheap to access. Corporate deal-making drove substantial earnings. M&A activities rebounded in 2021 after a substantial decline in 2020 yet many institutions missed the opportunity to apply right-sizing contracts for cost optimization during integration. Business growth was rapid, but short-lived, putting pressure on banks to rethink spending models and explore non-labor cost reduction strategies in banking.

The landscape has positioned banks to respond with focused cost efficiency strategies that drive not only immediate profit but also long-term agility.

Once interest rates began to climb and the economy started to flip, the business landscape rapidly changed. Deal-making dried up putting downward pressure on earnings. Low-cost borrowing was gone. Higher operating costs – some inflationary driven – had arrived. Organizations that had grown an inflated workforce expecting a boom to continue now face pressure to rethink operating models and pursue cost reduction strategies in the banking sector. Commercial banks have increased their loan loss reserves amidst mounting economic uncertainty, mortgage originations, and fee income is down significantly from last year, and banks are forecasting a decrease in lending profit and expecting depositors to start more actively searching for higher savings rates. This rapidly changing environment has exposed potential weaknesses in growth strategies across the sector and now has positioned banks to ask themselves, “What more can we do?” over these next 12 months.

How to Reduce Costs in the Banking Sector

While the first wave of cost reduction in banking has been on labor and a decrease in bonuses, as it is most of the time, banks should shift to other areas of spending. The landscape has positioned banks to respond with focused cost optimization strategies that drive not only immediate profit but also long-term agility. The majority of banks have set ambitious savings goals in years past and this is no different in 2023. However, the struggles of past initiatives to fully realize rapid savings opportunities against lofty corporate goals can no longer happen. 2023 is setting up for a year where banks must fully realize results. The opportunity is here to enhance profitability through operational efficiency strategies such as:

- Empowered decision-makers

- Centralized management of third-party spending

- Improved alignment between Business and Shared Services

- Rationalization and redirection of critical activities across existing teams

- Establishment of unified corporate goals

As cost reduction in banking becomes a greater priority, there are specific actions that these teams need to execute and deliver upon, which are areas that are ripe with opportunity. For banks, the challenges of successful cost savings execution have only been compounded recently given the declining growth trends within the banking sector. For example, banks have focused on significant acquisitions to expand their capabilities. The negative outcome of this growth has been a complex business model that creates natural waste, redundancy, and a lack of central control.

Banks can deliver expense value creation through comprehensive strategies including:

- A Shift from Risk to Right-Sizing: Central procurement teams have historically been focused on risk management, but a shift needs to happen. Right-sizing contracts for cost optimization, focus on driving cost out of every contract and align with the business on value-creation activities.

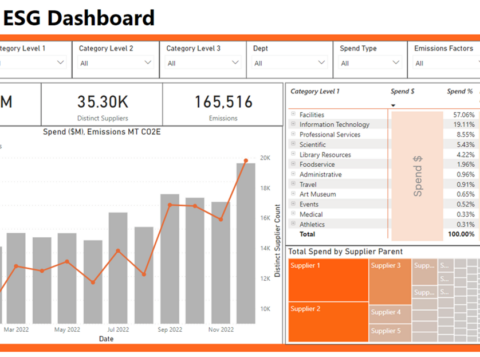

- Hyper-Focused Category Management: The complexity of a bank has created duplicative functions and third-party vendors engaging across multiple business units. Banks need to empower central resources to deliver cross-organizational savings strategies and drive category management with their key business partners and implement centralized third-party spending management to gain visibility and control over vendor relationships.

- Post-Synergy Value Creation: M&A activity within the banking sector has led to tremendous growth, but organizations have not fully realized synergies from this activity. Now is the time to revisit acquisitions and ensure that full synergies are still being realized and address missed opportunities that need to be realized soon.

- Spend Criticality Evaluations: Banking is changing and expense structures are changing as well. Banks have an opportunity to launch spend criticality evaluations to determine where there are waste and/or rationalization opportunities.

The Time to Act is Now

The convergence of rising interest rates, inflation, and uncertainty has set the stage for banks to win or lose in the next couple of years. Some have made their first response – layoffs and bonus cuts. Now is the time to make the second – a hyper-focused effort to manage and reduce non-labor-related costs. The uncertainty of the market is requiring more nimble and agile organizations. With a focused effort to remove costs from the expense line, banks can rein in spending, retain critical talent within their workforce, increase reserves to prepare for a potential recession, and navigate the market to be well-positioned in the future.

Interested in learning more about AArete’s Financial Services consulting services or Profitability Improvement solutions? Click below to read more about what we can offer your organization.