The Dual Role of Procurement Professionals

This is an AArete Profitability Improvement insight

Organizations have long treated procurement professionals as tactical buyers to find the lowest cost vendor, negotiate the contract, onboard vendors in the system, process the PO, and the like. But increasingly, executives are demanding more from procurement, expecting them to manage complex vendor portfolios, partner and drive operational innovation with the business, develop and execute category management strategies, deliver strategic value, and more.

If procurement wants to keep its influential seat at the table with the C-suite while continually delivering operational efficiencies and cost savings, it must integrate more deeply into its company’s operational frameworks and be viewed as an operations function.

For instance:

- When negotiating IT agreements, procurement should align with the organization’s IT roadmap to anticipate future technological needs, rather than investing reactively (which often leads to spending more time, money, and resources).

- In the healthcare payer sector, procurement should understand the intricacies of digital health programs, member health drivers, and total cost of care economics to make informed investment decisions in member programs.

But procurement can’t optimize what it doesn’t understand. When you operate disconnected from day-to-day workflows and broader business operations, decisions are based on requisition forms and vendor promises, not actual business needs. Procurement must understand how products and services impact business functions and create tangible value for the organization. Procurement leaders should be experts in their business.

Here are four ways procurement can improve operations integration and build credibility with stakeholders:

- Deploy usage analytics to find waste

- Build supplier partnerships that create value

- Embed strategic planning before decisions get made

- Build category expertise systematically

Let’s take a closer look at each.

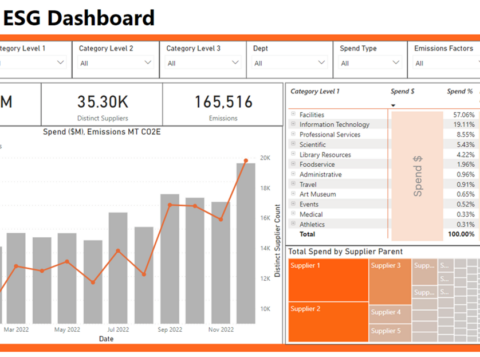

1. Deploy Usage Analytics to Find Waste

Most organizations don’t track whether purchased licenses get used. The solution lies in extracting login data from Microsoft 365, Adobe Admin Console, Salesforce, and other platforms you’re paying for. Even organizations with strong software asset management teams struggle to manage inactivity or unused licenses.

Every leader should ask a set of questions:

- How many named users do you have versus how many log in weekly?

- Which features are actually used versus which capabilities sit dormant?

- Where are you maintaining access for roles that don’t need it?

Request utilization reports from vendors, too, but make sure to frame the conversation around capacity planning for renewals, not compliance audits. Vendors resist transparency when they think you’re building a case to cut licenses.

Tell them you’re sizing for next year’s needs and they’ll cooperate.

After being empowered by data, start to challenge internal assumptions and validate when you discover research. In the data-centric environment with which we live, we have access to market data and expected spend, license counts, and redundant tools. Use this research to test your hypothesis.

Lastly, run redundancy checks across categories. Pressure test the need for redundancy and business continuity. Most organizations maintain multiple cybersecurity tools (Okta, CrowdStrike), cloud platforms (VMware, Snowflake), and collaboration systems because departments buy independently and nobody has cross-organizational visibility.

2. Build Supplier Partnerships That Create Value

Strategic suppliers know their domains better than you do. They:

- See patterns across hundreds of customers

- Understand which features customers actually use, and

- Know which configurations fail in practice

So ask them directly: What are we paying for but not using? Where could architecture changes reduce our footprint?

Engage suppliers before requirements are locked. They’ll surface capabilities you didn’t know existed and warn you off approaches that look good on paper but operationally fall short. Suppliers want to help, but only if you ask.

That said, trust but verify. Run quarterly business reviews — actual working sessions where you review performance data and explore optimization opportunities. These can’t be perfunctory check-the-box meetings. With this kind of diligent scrutiny, you’ll catch problems before they explode at renewal.

3. Embed in Strategic Planning Before Decisions Get Made

If your procurement team only hears about projects after business units choose their vendor, you’re processing paperwork, not doing strategic work and delivering upon the needs of your organization. Combat this knowledge gap by joining cross-functional planning teams. Your perspective and input are vital, especially when stakeholders are still figuring out requirements.

You see the entire vendor landscape while individual departments don’t, so be generous sharing market intelligence. When a supplier’s rolling out new capabilities that could replace two existing tools, say something.

Treat internal stakeholders as subject matter experts… because they are. They know their workflows, and you know the market. Combine those perspectives before requirements are set in stone.

Lastly, leverage your supplier partners. No one has their ear to the ground more than suppliers who live the industry they operative in on a day-to-day basis. Leverage their expertise on the industry trends and challenges. Ask them their opinion on cost savings and service improvements relative to your business.

4. Build Category Expertise Systematically

You can’t negotiate SaaS contracts if you don’t understand how SaaS pricing works. You can’t challenge vendor technical claims if you don’t know enough to recognize when you’re being sold unnecessary capabilities. Category expertise is the difference between getting value and getting played.

Invest time in learning the business of your suppliers and the intricacies of your major spend categories. Attend vendor webinars even when you’re not actively buying. Read analyst reports. Track market shifts. When everyone’s moving to consumption-based pricing, for instance, you need to understand what that means for your cost structure before you’re negotiating your next renewal.

Learn how deals actually work in each category. Marketing technology contracts are structured differently than HR systems. Cloud infrastructure pricing operates nothing like professional services agreements. Each category has its own vendor playbook.

And build networks outside your organization. Join procurement communities where people share what they’re seeing in negotiations. Someone out there just negotiated the exact contract you’re looking at and can tell you where the leverage points are.

Conclusion

Procurement proves its value by solving operational problems. Organizations that embed procurement in daily workflows, such as tracking actual usage, building supplier partnerships, and participating in planning cycles get measurable results. Lower costs, better vendor performance, fewer surprises at renewal.

This requires procurement professionals to develop fluency in the categories they manage. Learn how your vendors price. Understand what your stakeholders actually need versus what they think they need. Build relationships with suppliers who can help you optimize, not just sell.

Execute these priorities consistently and procurement stops being viewed as an administrative function. It becomes infrastructure, essential to managing vendor complexity and protecting margins and earning its seat at strategic discussions.