Reimagine Banking Branch Experiences and Profitability Using Advanced Analytics

This is an AArete Financial Services insight

Over the last decade, there has been at least a 15% decrease in branch locations across the U.S. as financial institutions have prioritized modernizing their digital offerings for customers and clients while also reducing costs by downsizing and closing branch sites. There is little dispute that this trend will continue over the next few decades as traditional branch customers get older, younger generations change banking and investing habits by adopting digital platforms, mobile banking handles more transactional needs, and operational economics point to digital channels as less costly options than physical branches.

However, over a decade ago as digital transformation took over the banking industry, major research outlets were taking even stronger views, saying that the branch model is officially DEAD! Research strongly recommended that banks focus solely on investing in digital strategies moving forward. COVID-19 further strengthened that narrative. Yet today, more advanced research and data analysis suggests that there remains intrinsic value to the branches serving the communities across our nation.

Major financial institutions like JPMorgan Chase, Bank of America, PNC, U.S. Bank, Fifth Third, Huntington, and Valley Bank have publicly communicated their branch expansion and reinvestment strategies. These efforts are centered on the view that newer and more modern branches will remain critically important to providing complex advisory services, building customer and client relationships, and establishing a stronger brand presence in key markets. These banks are emphasizing the importance of using the branch to build greater trust with their customers, maintain a physical presence in markets with critical demographic groups, and create opportunities for more personalized engagement. Therefore, these and many other banks continue to invest in opening new branch locations in high-growth regions, renovating existing branch sites, and acquiring competitors to consolidate their existing footprint for synergy gains while also enabling access to new regions.

Overall, it is anticipated that net branch counts will continue to fall over the next ten years as digital becomes the primary banking channel. There will be more branches closed and consolidated than new branches opened. However, these new branches represent a strategic redistribution of physical banking as opposed to a full retreat away from the branch model that has served communities for generations. The value of branches is quickly evolving. The primary value of today’s branch locations is transitioning to an advisory hub for customers and the wider communities that they serve. With this new advisory role, financial institutions must revitalize branches with a personalized approach driven by customer behavioral data, AI-driven predictive analytics, and demographic insights.

Defining your customer’s “moments that matter” at the branch

Customer experience (CX) strategies in the banking industry and across other industries often focus on the concept of moments that matter to customers. This refers to critical touchpoints in your customer’s journey where you want to have a hugely positive impact on that customer’s experience. Now, think about this in the context of a bank’s branch strategy. These moments that matter to customers when they visit the branch could be moments of extreme joy. However, they also could be moments of extreme anxiety for those customers too.

You probably don’t remember every single trip you ever made to the branch to deposit a check (remember filling out those paper deposit forms long before mobile check deposit was even available?). However, you likely remember the time:

- When you visited the branch to get your first mortgage or to get that bank-certified check that you used when you purchased your first home.

- When you and your newly married spouse went to the bank together to open your first joint account and deposited all those wedding gifts from your family and friends.

- When you wanted to start your new business in town or a new side gig venture and needed to secure a loan from the branch to do it.

- When you got your first job and opened that first deposit account and later your first brokerage account at the branch.

- When, sadly, you may have been a victim of fraudulent activity in your bank account or another form of identity loss and traveled to the branch to resolve these issues.

These examples and many others make up the moments that matter for a branch customer. They are the most important moments in that customer’s financial life where they are relying on their bank’s branch to advise them. And these moments that matter at the branch are changing and are not going away as quickly as some may have predicted in the past. If the branch is structured to be that customer’s advisory hub for these and other moments that matter, then the branch will continue to bring value and survive.

Understanding detailed customer interactions at the branch

New streams of customer data provide more granular views today than ten years ago of how individuals interact with the branch network, especially in these moments that matter. For example, card swipes provide some of the most notable customer behavioral data points, whether at the teller counter or window, at a personal banker’s office desk during loan discussions, or simply at the ATM. Swipes serve as physical check-ins revealing foot traffic patterns, visit timing, and the types of reasons why customers are visiting the branch. Understanding customers’ interactions within a branch provides valuable insight into what services are most valuable and at what points in time throughout the year. Combining that data with demographic information and structured observations of the questions customers ask and the topics they discuss during their visits provides invaluable insight that helps branches evolve to meet more complex advisory needs.

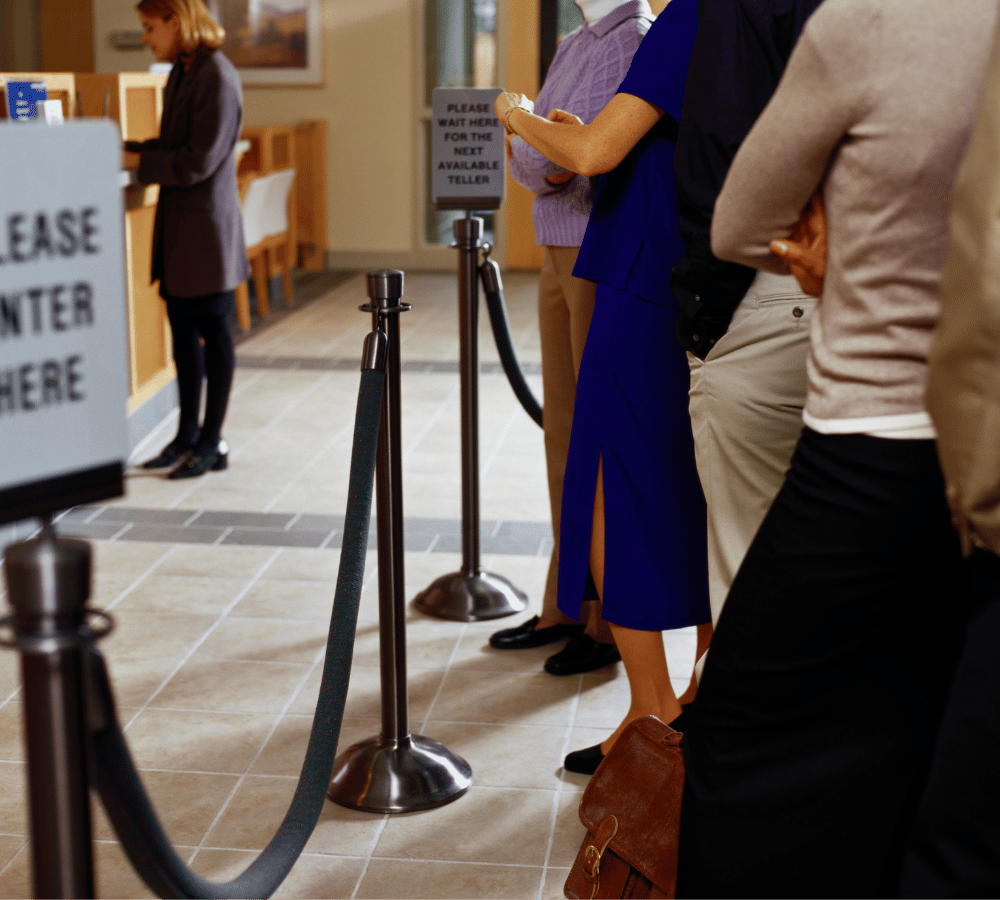

Let’s take a simple example. We’ve engaged with numerous Baby Boomers on this topic who still use the branch as their primary banking channel. They wait in long lines at the teller counter since many branches have reduced the number of tellers to manage costs. Some of these Boomers accept the long lines as the tradeoff for not adopting digital banking. Other Boomers get frustrated by the long lines, but they aren’t planning to change their bank at this stage in their life. However, what about those days when a younger customer, let’s say a Millennial or even someone from Generation Z, took off from work because they had to visit the branch for one of these moments that matter.

When they arrive at the branch, they get caught in these long, frustrating lines and by the time they reach someone to assist them, it has already completely soured their branch experience. This experience leaves such an impression that they commit to changing banks in 30 days (“I’m never going back there!”). They stick to their commitment, close their accounts, and move to a new digital bank next month. With the right propensity models, a branch can prepare for these and other scenarios, as well as avoid costly retention risks.

Layering in external market data for deeper branch insights

Customer behavioral data can also be layered over external market trends and geo-data allowing financial institutions to not only identify the needs of their active branch customers but also spot service gaps and product opportunities. External market research is useful at the national level but is even more valuable when focused on the specific communities that a branch serves. This data can yield valuable insights that drive opportunities for new services.

Maybe there’s an uptick in the volume of commercial business in the area. Maybe there’s a planned increase in the concentration of car dealerships in proximity to the branch over the coming years. Maybe it’s a buyer’s market for local real estate. Branches should prioritize understanding their customers first, then leverage market and macro data to recognize the future services a branch’s community needs. For example, using this approach, the banks mentioned above are expanding in high-growth cities such as Austin, Dallas, Houston, Phoenix, Denver, Miami, Orlando, Tampa, Atlanta, Charlotte, and Raleigh. This approach enables banks to identify areas for branch growth and increase market share by becoming advisory hubs for those cities and larger communities.

Leveraging predictive analytics to improve branch experiences

Banks report that digital growth is faster in markets where they have branches. However, branch sites are costly to maintain and, if not managed properly, can weigh on bank profitability. Banks are increasingly using advanced analytics to make their branches more efficient, customer-centric, and profitable. Once institutions understand where and how their future customers are going to interact within the branch, they can use these insights to further streamline the customer experience. For example, using data points from card swipes, institutions can see customer demographics, transaction types, and periods of high activity. These data points allow branches to predict the types of customers and transactions at a given day and time and adjust their resources accordingly. Banks are also integrating technology into branches such as interactive teller machines and digital kiosks to offer a seamless human plus digital experience.

The use of predictive analytics and real-time dashboarding is enabling a better understanding of sales trends, transaction costs, peak foot traffic patterns, and customer volumes and wait times. Combining physical customer data with digital and call center data is providing more complete views of the customer, their transaction histories, life-stage indicators, and preferences to improve personalization at the branch including, for example, identification of mortgage readiness and investment opportunities. Many banks may say that they do this already. However, only a select few do it well, and there is so much more that can be done. For example, do you still get all those letters in the mail or in your inbox offering you loans, mortgages, and credit cards that you absolutely don’t need? They go right in the trash! Or how about all those cashback deals for services and retailers that are irrelevant to you? It’s amazing how out of touch your bank can be with your needs! As a better example, banks are partnering more with relevant third-party vendors, such as point-of-sale (POS) system providers, to be on-site during specific times to offer value-added experiences for small business owners when they visit the branch to make their weekly cash deposits. These partnerships benefit the POS providers, but they also benefit the customers who are being introduced to relevant providers for their business endeavors.

Leveraging predictive analytics to improve branch profitability

Beyond personalized experience, predictive analytics and real-time decision engines are also being used to improve operational efficiency and reduce spending. Combing customer data with branch operational data such as branch operating expenses, cash replenishment needs, ATM transaction trends, and teller usage patterns uncover meaningful ways to automate processes, reduce costs, and better allocate resources. Combining that with machine learning and anomaly detection provides real-time branch fraud and risk detection controls to reduce future fraud investigation and compliance costs.

For example, using advanced analytics to forecast cash needs with greater accuracy supports leaner cash operations. This can include a reduction on transportation costs for armored cash transport vehicles. As another example, using predictive maintenance solutions can improve maintenance schedules before costly emergency failures occur, as well as improve maintenance across branch sites through centralized branch data management solutions.

Another sizable need that we’ve seen demand for in the market is profitability solutions that help to better manage branch construction costs as banks expand into the Sun Belt, Southeast, and other high-growth regions, as well as renovate branches following mergers and acquisition-driven consolidation activities. Managing these projects in a profitable manner against aggressive costs while meeting forecasted timelines is a major challenge. New data solutions are opening up AI-driven predictive analysis pathways to improve profitability across the entire branch construction lifecycle from site identification to architecture and engineering services, and from contractor selection and negotiation to fixtures, furniture, and equipment (FF&E) decisions. For example, we’ve successfully used a proprietary real-time control tower solution for new branch completion analysis focused on spending and solicitation of real-time feedback from vendors to manage potential risks and identify when alternative decisions need to be made based on current market conditions. The savings potential utilizing these types of solutions is sizeable.

Using data to improve banking for low-income communities through branch services

Recent research has shown that when low-income communities have branch access, the savings rates in those communities increase while financial strain eases. These communities gain valuable access to information that enables them to make better financial decisions for themselves and their families. This helps families to better manage their money, build up a credit history, and set goals with longer-term success plans.

Through analysis of demographic data, such as average income, ethnicity and cultural factors, banks can evolve personalized branch experiences for these lower-income communities. In-person services and additional opportunities like educational workshops are often more beneficial for these customers. A branch in a lower-income community can, and should, offer a much different experience than a branch located in a more affluent area, because the top-of-mind concerns for each customer base vary greatly. By leveraging demographic data, institutions can identify the unique services each community requires. In turn, the branches will provide personalized experiences that can lead to lifelong customers. In recent years, we have seen great examples of bank branches supporting local communities through small business loans, affordable housing financing, and other charitable initiatives. Even mobile branches and branches-on-wheels have taken to the streets to serve these customers! This trend will only continue to grow.

Rethinking branch strategy and redistribution

Although the total number of branch locations will decrease in the coming decade, their strategic importance will continue to evolve. Reimagining branch strategy will allow physical locations to serve as an essential part of an omnichannel customer experience. Creating meaningful branch experiences will require a blend of customer behavior data with predictive analysis and local demographic context while managing branches in a cost effective and profitable way. Using these strategies, financial institutions can evolve branches into trusted advisory hubs focused on areas such as wealth management, mortgages, small business banking and other moments that matter while creating personalized customer services that respond to the financial needs of the communities they serve.