Navigating the OBBBA’s and Probable Expiration of ACA Subsidies’ Impact on Medical Loss Ratio for Medicaid and Marketplace Plans

This is an AArete Healthcare Payer insight

With medical loss ratios (MLRs) climbing and the One Big Beautiful Bill Act (OBBBA) and probable expiration of enhanced ACA subsidies adding new cost pressures, some Medicaid and Affordable Care Act (ACA) Marketplace health plans feel as if they’re reaching a financial breaking point.

In response, payers are pulling every financial lever to keep their MLRs manageable. Yet in doing so, they can fall into the old trap of addressing administrative and medical costs in isolation, when in reality they’re interconnected. Lowering costs in one area can unintentionally raise expenses in another. Also, ACA plans substantially raising premiums to compensate for higher costs from higher acuity membership, they are pricing themselves out of the market for some members unless they focus on lowering medical costs.

What’s needed is a more strategic approach to cost reduction that can turn a breaking point into a turning point, creating improvements in operations, member satisfaction, and care access.

Let’s examine how the OBBBA and probable expiration of ACA subsidies may affect Medicaid and Marketplace plans, understand warning signs of an MLR breaking point, and discover five principles to help payers weather the oncoming storm.

Assessing the OBBBA’s Market and Policy Impacts

While it may take two years or longer to realize the full impact of the OBBBA, its near-term implications for Medicaid plans are real.

For Medicaid Plans: Multiple Challenges Ahead

The OBAAA will result in a cascade of pressures for Medicaid plans. First is declining membership. The Congressional Budget Office forecasts that about 5.2 million fewer adults will be covered by Medicaid by 2034 due to the OBBBA’s work requirement provisions, and most of them will become uninsured.

As enrollment drops, so will revenue. Simultaneously, member acuity will rise, extending pressure on MLRs. Administrative burdens will also increase, with work requirements expected to trigger more frequent eligibility checks. And when eligibility redetermination timelines shrink from 12 to six months in 2027, the amount of back-office work could double.

Equally concerning is the gradual reduction in the maximum allowable provider tax rate from 6% to 3.5% by 2031. As the tax rate lowers and states receive fewer direct payments, Medicaid plans will need to renegotiate provider contracts and either hold the line or reduce reimbursement rates to remain financially stable.

Access to care will become an issue, too, with potential Medicaid funding gaps expected to impact rural hospitals the most. Medicaid plans must find ways to maintain access to care, potentially raising spending on items like transportation or telehealth to meet the health needs of members in rural areas.

For Marketplace Plans: Post-Subsidy Pressures

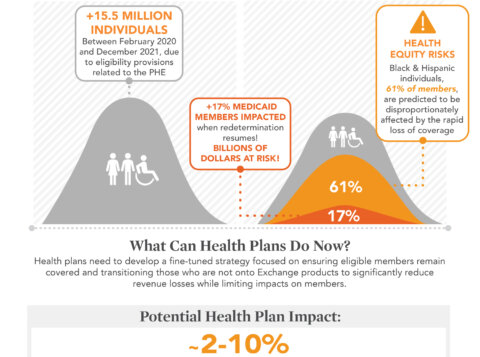

The enhanced ACA subsidies initially expanded under pandemic relief measures are likely to expire, reshaping the market for marketplace plans. Membership may be hit hard as some members, now facing higher premiums, drop their coverage or migrate to alternative products, such as short-term limited duration plans.

A potential exodus of healthier members may deteriorate the risk pool, leaving plans with a higher-acuity population that will drive up medical costs. Simultaneously, increased churn between Medicaid, ACA, and uninsured segments will raise administrative costs associated with member enrollment and care continuity.

Plans relying heavily on ACA enrollment could experience revenue compression as members shift to lower-premium tiers or lapse entirely. And as carriers recalibrate their participation and pricing strategies in certain regions, competitive pressure will increase, too.

MLRs are Headed for the Danger Zone

All the OBBBA and ACA enhanced subsidy’s short-term and long-term implications come as MLRs are already entering dangerous territory. Medicaid plans in particular are still grappling with the end of the COVID-era redetermination pause, which removed many of their healthiest members. Utilization, meanwhile, continues to skyrocket across all plan types.

Have we reached an MLR breaking point? While the answer depends on the individual plan, the warning signs look similar. MLR becomes unsustainable when it reaches the 90s and administrative costs push it over 100. Other trouble spots to watch for:

- Negative margin trends across multiple quarters: When a trendline develops, it’s a huge red flag.

- Shifts in leadership discussions: Early MLR pressures will generate conversations about tactical cost-cutting; more serious concerns will trigger talk about organizational alignment.

- Staffing shortages and burnout: Workforces that are stretched thin create staff overload and exhaustion, leaving valuable employees heading for the exits.

- Declining member experience and satisfaction scores: If not addressed quickly, ongoing member dissatisfaction will lead to churn.

- Struggles to balance cost containment with growth and market share: Payers risk losing their ability to scale when budget shortfalls cause new projects to stall out.

These breaking points don’t have to spell doom. Instead, payers should use them as a sign that it’s time to make a few strategic shifts.

Risks of Tackling Cost Pressures in Silos

When external policy pressures like the OBBBA arise, payers often approach cost reduction tactically, assigning separate targets to administrative and medical teams. This siloed approach, however, rarely produces sustainable results for Medicare or Marketplace plans. Here’s why.

Consider a Medicaid plan that relies on a medical management vendor to reduce medical costs by 1% to 3% annually. The medical team understands that vendor’s contribution to the MLR. The administrative team, however, may not. If the admin team works in a silo and chooses to end the vendor’s contract as a cost-cutting initiative, that choice will raise medical costs instead of lowering them, wiping out the potential net benefits.

The same is true for Marketplace plans. Take the example of administrative leaders who, under intense pressure to reduce costs, choose to lower a plan’s current level of incentives for brokers. The ripple effect reduces new member acquisition and retention, leading to a smaller risk pool and higher per-member-per-month medical costs.

These decisions don’t only affect the medical spend. They also impact the member experience. Consider a plan that eliminates non-emergent transportation. It may yield the expected benefit of cutting administrative costs. But it also could result in avoidable ER visits and worse health outcomes for members. It can also send member satisfaction plummeting, leaving patients without reliable transportation scrambling to find alternatives.

5 Ways to Turn Breaking Points into Turning Points

Complying with shifting regulations doesn’t have to create an MLR breaking point. These five principles can help payers stabilize MLR across Medicaid and ACA plans.

Reassess Cost Categorization

Some health plan functions, such as case management or care coordination, directly impact member health and quality of care. As a result, they may be appropriately reclassified as medical expenses. Doing so can improve MLR performance without cutting essential services. Larger plans may have the expertise to perform recategorization in house, but small-to-midsize plans should consult an expert consultant, so they don’t miscategorize expenses or over-report administrative costs.

Strengthen Vendor ROI Accountability

Many clinical and administrative vendors still self-report their ROI to payer organizations. But how do you know if those numbers are accurate? Creating a dedicated vendor management team can pressure-test the ROI and ensure vendors deliver the savings they promise. It will also give plan executives accurate data they can use to make wiser decisions at vendor contract renewal time.

Leverage Practical AI

Almost every plan is actively researching and implementing AI right now. The question is: Where will it deliver the most bang for the buck? A smart first step is to digitize all provider contracts into structured formats, which will help streamline contract configuration. Additionally, applying AI in areas like claims accuracy and churn prediction will reduce avoidable costs, improve member engagement, and make staff more efficient.

Expand Value-Based Care (VBC)

Medicaid and ACA plans should continue moving toward outcome-based provider agreements that reward quality care. Winning with VBC, however, requires precision. Plans must carefully align incentives with payers and providers. They must also understand that value-based contracts will need time to mature before they begin creating meaningful ROI.

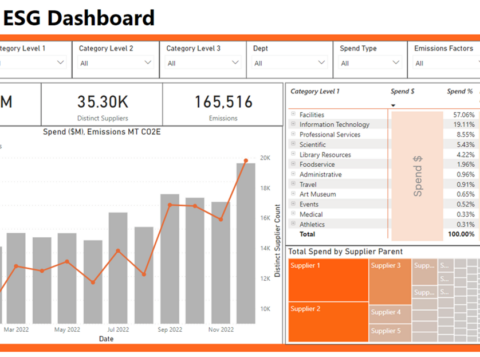

Optimize Payment Integrity (PI) Holistically

Most payers currently have multiple PI vendors. Each one captures a percentage of savings, but few fix the root causes of costly claims challenges. A smarter approach is to move from fragmented point solutions to integrated PI strategies that identify the underlying reasons for overpayment and leakage.

Thrive in a Post-OBBBA Environment

The OBBBA and the likely expiration of enhanced ACA subsidies may feel like separate challenges, but the underlying lesson is the same: cost pressures can’t be solved in isolation. Health plans that align administrative and medical cost strategies—and tailor them to the realities of their Medicaid and ACA lines of business—can turn today’s breaking points into tomorrow’s growth opportunities. Those that fail to integrate will face escalating MLRs, shrinking margins, and greater competitive risks.