The Health Plan Playbook for 2026

2026 OUTLOOK: Turbulence Ahead for Health Plans

An essential review of the biggest challenges and opportunities for healthcare payer organizations heading into the new year

The Federal Budget Reconciliation Act (the “One Big Beautiful Bill”) has created widespread uncertainty and its full implications remain unclear. Health plan leaders can’t wait for clarity. They must enter 2026 with a defined strategy, ready to adapt to any scenario.

AArete healthcare consulting leaders, informed by market intelligence and client experience, have identified three priorities for 2026:

This playbook explores each focus area with actionable strategies and concludes with five trends health plans should watch closely in 2026.

Key pressures include:

RISING DRUG COSTS: Relief remains unlikely. Unit prices continue to climb. Government-mandated rebates and the 340B Program, designed to reduce the net cost of certain drugs, can also contribute to higher list prices. Broader use of specialty drugs for common conditions like weight loss adds pressure. New gene and cell therapies improve outcomes for a small subset of members but sharply raise costs.

ESCALATING BEHAVIORAL HEALTH DEMAND: Claims and requests for Long-Term Services and Supports (LTSS) continue to surge. Digital-first care options proliferate, but many lack clinical oversight, vary in quality, and heighten upcoding risk.

PERSISTENT INFLATION: Inflation (up 3% as of September 2025) is driving up unit prices for services and fueling contentious contract negotiations between plans and providers.

PROVIDER SHORTAGES: Ongoing deficits in primary care, behavioral health, and specialty clinicians limit access and increase reliance on out-of-network providers and emergency departments, quietly driving up unit costs.

PRIORITY COST OF CARE MANAGEMENT ACTIONS FOR PAYERS IN 2026

INTEGRATE DRUG UTILIZATION DATA INTO CARE MANAGEMENT

Specialty drugs like GLP-1s will accelerate costs across all lines of business. Use predictive analytics to track high-risk members and intervene early, and require clinical documentation for drugs used outside of FDA-approved indications.

USE AI TO MONITOR DRUG & BEHAVIORAL HEALTH CLAIMS

Behavioral health claims, especially from virtual providers, require thorough pre-authorization and post-payment review for clinical appropriateness. Apply real-time analytics to flag anomalies in dosing, refill frequency, and visit intensity. Tighten credentialing and require outcome reporting for behavioral health platforms.

MODERNIZE UTILIZATION MANAGEMENT

Shift from rigid rules to AI-enabled interventions that predict avoidable costs and personalize member engagement through proactive outreach, virtual carerouting, and digital navigation tools.

The road ahead includes:

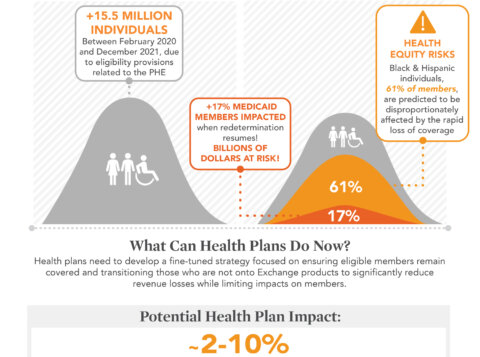

More Frequent Redeterminations

Medicaid renewal periods for ACA expansion adults will shorten from annually to every six months after December 31, 2026. This may effectively double the workload for eligibility teams and increase the risk of coverage loss due to administrative errors.

Tougher Verification Requirements

Between 2027 and 2029, states are required to run quarterly deceased benefit checks and disenroll ineligible members. The policy improves oversight but creates a heavy, recurring data burden for plans and state agencies.

Higher Administrative

Costs

Combined, these mandates will increase costs for both health plans and states. Payer organizations must balance fixed costs with variable costs to reduce administrative expenses should membership decline.

Shorter Enrollment Periods

The Act also tightens open enrollment periods starting November 1, 2026. This will create a more compressed timeframe for member acquisition and retention efforts.

An AI-driven

Claims Surge

Providers using autonomous coding, ambient scribes, and EHR prompts are generating claims faster than payers can process them. The upside of better documentation comes with an avalanche of transactions that can overwhelm legacy systems.

Provider Directory

Compliance

A new CMS rule requires MA organizations to submit directory data for publication in the Medicare Plan Finder, update it within 30 days of any changes, and attest annually to its accuracy. Plans without automated data management will struggle to stay compliant.

PRIORITY AI-DRIVEN ACTIONS FOR PAYERS IN 2026

AUTOMATE HIGH-VOLUME,

RULES-BASED WORKFLOWS:

The biggest opportunity lies in automating repetitive, high-touch processes such as claims intake, eligibility checks, and verification reviews. AI can analyze and process claims faster, increase auto-adjudication rates, and shorten settlement times. Automation also enables strategic shifts such as bringing prior authorization in-house for more control and faster member access.

APPLY AI TO

CONTRACT MANAGEMENT

Using AI can transform unstructured data such as reimbursement methodologies and complex carveouts into actionable, structured insights. Payers gain full visibility into contract terms so that reimbursement rules are applied accurately across claims systems. This helps payers validate reimbursement accuracy, resolve disputes faster, and maintain transparent, consistent provider relationships.

ADOPT PHASED,

ACCOUNTABLE AI GOVERNANCE

Deploy new tools incrementally, monitor impact metrics, and train teams by role to build trust in AI-assisted decisions. Assign internal champions for quality control, regulatory compliance, and responsible data use.

AI AGAINST AI:

TAKE BACK CLAIM CONTROL

As providers submit claims faster, payer-side AI must evolve in parallel. Machine learning can pre-adjudicate claims, flag anomalies in real time, and route exceptions for human review. Maintain claim-level transparency and keep Provider Relations teams informed for a continuous feedback loop. Shifting more arrangements from fee-for-service to value-based

contracts may lower claim velocity, too. However, it creates new demands on providers to share quality and risk adjustment data so plans can maintain complete reporting and oversight.

MAINTAIN ACCURATE

PROVIDER DATA

CMS’s new directory rule demands near-real time accuracy. Use AI to summarize provider contracts and credentialing documentation and to identify and remove inactive providers from your directory. Automate credentialing checks, remove inactive providers, and trigger directory updates within 30 days of any change to avoid penalties and enrollment loss.

REINVEST EFFICIENCY GAINS

INTO MEMBER EXPERIENCE

Redirect savings from automation into programs that elevate the member journey: enhanced benefits, proactive care management, and personalized digital engagement tools. Dashboards that unify claims, clinical, and behavioral data can give members a 360-degree view of their health.

PRIORITY GROWTH & RETENTION ACTIONS FOR PAYERS IN 2026

STRENGTHEN CARE MANAGEMENT

AND PROVIDER COLLABORATION

Develop high-touch programs that help members manage chronic conditions and reward providers for cost-effective care. Value-based contracts and shared-risk arrangements can align incentives and improve outcomes.

USE CHURN ANALYTICS TO

PREDICT MEMBER MOVEMENT

Leverage predictive modeling to calculate churn propensity based on member attributes such as missed re-enrollment dates or utilization trends. (Use CRM data — including call center activity, digital interactions, utilization and claims data, and SDOH attributes — to build churn propensity models.) This data can help organizations retain at-risk members and minimize avoidable attrition.

INVEST IN MEMBER ENGAGEMENT

AND RETENTION JOURNEYS

To strengthen loyalty among healthier members, move from claims-centric to member-centric engagement. Use AI insights to personalize outreach by channel

— email, text, or social — and reward healthy behavior. Proactive, individualized communication keeps healthier members engaged and in the pool.

REFINE PRICING

AND BENEFIT STRATEGIES

Use data-driven forecasting to anticipate utilization, identify emerging risks, and adjust premiums and benefits accordingly. As CMS enforces tighter transparency rules requiring payers to share accurate pricing data, plans must regularly recalibrate networks, provider mix, and preventive offerings to stay competitive.

5 Crucial Trends for Health Plans to Watch in 2026

1. BUDGET RECONCILIATION

ACT SUBSIDY DECISIONS

The fate of enhanced ACA subsidies remains unresolved at publication. If federal support lapses, both Marketplace and Medicaid risk pools will shift sharply. Expect higher premiums, member churn, and a spike in uninsured rates. Plans should monitor enrollment closely and prepare leaner 2027 product options (such as lower-cost bronze tiers) to retain or recapture members.

2. BEHAVIORAL HEALTH

UTILIZATION CURVE

Utilization continues to rise, and the potential cost impact is compounded by inconsistent clinical oversight among digital-first providers. Behavioral health will remain a top MLR driver through 2026. Payers must tighten credentialing, strengthen outcome tracking, and use analytics to separate appropriate use from overutilization before costs escalate further.

3. CYBER THREATS TARGETING

PAYMENT SYSTEMS

Healthcare led all industries in third-party data breaches last year (78 incidents) with an average loss of $7.42 million per event. Most payers have IT recovery plans, but few are ready for downstream business disruption that can last weeks or longer. Be sure to evaluate vendor risk, enforce stronger controls, and maintain contingency plans to preserve operational continuity.

4. EMPLOYER-DRIVEN COST

CONTAINMENT STRATEGIES

Employers are taking a more active role in healthcare spend, demanding transparency and

exploring alternatives such as integrated medical-pharmacy benefits or PBM unbundling. Plans should anticipate modular, customizable benefit models that let employers shape networks and drug programs more directly.

5. SHIFTS IN MEDICARE ADVANTAGE MARKET SHARE & FINANCIAL OUTLOOK

Shrinking federal reimbursements are already prompting major payers to exit unprofitable MA and Part D markets. Retention and efficiency will become the defining success factors in 2026, with plans increasingly favoring lower-cost HMO structures over broad PPO networks to preserve margin.