Improving Payer Member Retention with Churn Analytics

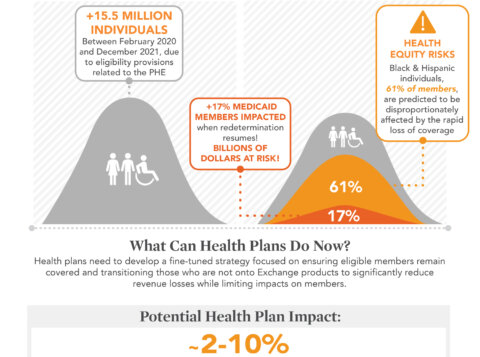

For health plan leaders, growth is a strategic imperative. Yet managed care organizations (MCOs) cannot scale effectively when 10% to 25% of their members disenroll each year.

This harsh reality cuts across all lines of business, with Medicare and Medicaid plans hit especially hard. Even more frustrating is that many organizations lack visibility into why their members leave, making it difficult to act until it’s too late.

The good news: 30% to 50% of member churn is voluntary and preventable. But health plan leaders need to know where to look. Enter churn analytics. Health plans that capture and use churn data can re-engage at-risk members, drive satisfaction, and protect long-term growth. Here’s what’s at stake — and how to move from being a reactive organization to a proactive one.

Why Churn Happens

Although churn happens for disparate reasons, most disenrollments arise because of member dissatisfaction. Members today expect a combination of self-service and personalized assistance from their health plans. They want to be active participants in their care journey and expect to engage with plans in real time, on their terms.

Too often, however, members’ expectations do not meet reality. Our research at AArete, which includes a review of multiple plans’ member satisfaction surveys and other data, shows that voluntary turnover happens most often due to:

● Lack of engagement, including not understanding re-enrollment timeframes or processes

● Low-quality support and unresolved issues, evidenced by poor first-call resolution rates for basic inquiries

● Ineffective care management, such as members with diabetes not realizing the potential benefits or criteria for participation in chronic care management plans

● General, impersonalized messaging that does not address a member’s specific health needs

● Confusion about benefits, such as a member not understanding coverage for telehealth behavioral health services

● Poor self-service capabilities, including the inability to find and select an in-network primary care provider quickly

These factors are signals that churn analytics can help detect and address before members disenroll.

Weighing the True Costs of Churn

Poor member satisfaction costs MCOs more than they might think, both in terms of patient outcomes and profitability. Our data shows that replacing a lost member costs five times more than retaining one, with acquisition costs ranging from $500 to $1,500 per member versus $100 to $300 annually to retain.

Multiply that by the average churn rates across lines of business, and the high costs of member dissatisfaction become clear:

● Medicare, Medicaid, and Medicaid Managed Care: 15% to 25% churn rate

● Medicare Advantage: 10% – 25% churn rate

● Marketplace: Up to 25% churn rate

● Commercial: 5% to 10% churn rate

Reducing churn by just a tiny percentage changes the equation on two levels. For one, higher member satisfaction means better adherence to care plans and improved health outcomes. For another, a 5% reduction in churn can boost profitability by 25% to 95%.

Our data shows that replacing a lost member costs five times more than retaining one, with acquisition costs ranging from $500 to $1,500 per member versus $100 to $300 annually to retain.

Tracking the Best Churn Analytics Metrics

Creating a proactive member retention strategy relies upon having the most accurate data possible. For most plans, collecting churn data starts by calculating their historical churn rate. Next, organizations need data that paints a deeper picture of each member’s care journey. That’s where churn analytics take center stage.

Churn analytics identify key drivers of churn and predict a member’s likelihood of leaving a health plan. While most health plans already have this data, it’s often spread across disconnected systems, making it difficult to consolidate, analyze, and act upon.

To address this challenge, many health plans are turning to CRM platforms like Salesforce, which provide a unified 360-degree view of the member journey so plans can monitor, model, and respond to churn risks. Examples of high-level churn analytics include:

● Overall churn rate

● Voluntary vs. involuntary churn

● Churn by member segment

● Member engagement scores

● Member satisfaction scores

Once plans track and follow these metrics, they can dig deeper into specific elements, including:

● Call center activity (call frequency, first-call resolution, unresolved issues)

● Digital interactions (web or app logins, portal engagement, email clickthrough rates)

● Utilization and claims data (ED visits, hospitalizations, medication adherence)

● Social Determinants of Health (SDOH)

● Enrollment in value-added programs, such as care management programs

Using this data, plans can create attribution models that calculate a churn propensity score. With this metric, plans can identify, for example, that 15% of members are at risk for voluntary churn due to disconnected systems, such as a case management platform not syncing with claims data. Or data may show that more than 40% of recertification churn is due to members not knowing their re-enrollment dates.

Acting Upon Churn Data

Once plans know each member’s churn propensity score, they can segment members by persona and create personalized outreach strategies to win them back and keep them on an appropriate care journey. These strategies can include:

● Sending reminders about appointments, vaccine due dates, and prescription refills to members’ mobile devices via text message or through push notifications

● Creating web portals containing new member packets and newsletters, benefits-related information, health risk assessments, and incentives for healthy behaviors

● Sharing updates on care management topics and offering Q&As with providers on social media

● Providing high-touch care management journeys through call centers, chatbots, and customer service portals

● Hosting community events to address SDOH such as housing needs, childcare, or food delivery for vulnerable enrollees

Plans can also use their churn analytics to improve patient outcomes. Personalized reminders about annual wellness visits and routine teeth cleanings, for example, can re-engage members before they disenroll. For patients who need chronic care management, churn analytics can trigger invites to tailored programs.

Consider the impact of connecting a patient with poorly controlled diabetes not only to a diabetes care management program, but also to a smoking cessation program. Chances are, they will be grateful for the added support while improving their care plan adherence and their individual health.

Achieving Member Retention Without Adding Complexity

AArete empowers MCOs to develop data-driven member retention strategies without adding overhead. We bring more than 15 years of healthcare payer consulting expertise to MCOs, along with a deep knowledge of CRM software such as Salesforce. Our team helps payer organizations track the right churn analytics and create actionable attribution models.

We also collaborate with health plans to explore and implement multiple tactics that will boost member satisfaction. A unified member retention strategy can create a powerful synergy that benefits MCOs and their members. Ready to begin? Connect with AArete today.